do you have to pay taxes on inheritance in tennessee

Up to 25 cash back Update. Tennessee is an inheritance tax-free state.

The 35 Fastest Growing Cities In America City Cheap Houses For Sale Best Places To Live

Tennessee will require the executor of an estate.

. Thats because federal law doesnt charge any. All inheritance are exempt in the State of Tennessee. The first rule is simple.

However taxes can be a complicated subject. There are NO Tennessee Inheritance Tax. It is one of 38 states with no estate tax.

Free Inheritance Information For You Your Lawyer. Tennessee used to impose its own estate tax which it called an inheritance tax This tax ended on December 31 2015. Inheritance tax is imposed on the value of the decedents estate that exceeds the exemption amount applicable to the decedents year of death.

The inheritance tax applies to money and assets after distribution to a persons heirs. In 2020 there is an estate tax exemption of 1158 million meaning you dont pay estate tax unless your estate is worth. 1 A capital gains tax is a tax on the proceeds that come from the sale of property you may have.

Here are the frequently asked questions about Tennessees inheritance tax. If the total Estate asset property cash etc. If the total Estate asset property cash etc is over 5430000 it is subject to.

For deaths occurring in 2016 or later. More importantly people are looking to understand when taxes apply and when people do not have to pay them. Tennessee has updated its tax.

It allows every Tennessee resident to reduce the taxable part of their. There are NO Tennessee Inheritance Tax. All inheritance are exempt in the State of.

The state doesnt have. For example if a Tennessee resident receives in Heritance from someone who died in Pennsylvania they can possibly be subject to a Pennsylvania inheritance tax. Ad Get an Estate Planning Checklist More to Get the Information You Need.

These states have an inheritance tax. Free Inheritance Information For You Your Lawyer. However there are additional tax returns that heirs and survivors must resolve for their deceased family members.

An inheritance tax is a tax on the property you receive from the decedent. There is no federal inheritance tax. Although there is no federal tax on it inheritance is taxable in 6 states within the US.

Inheritances that fall below these exemption amounts arent subject to the tax. Who has to pay. As of 2021 the six states that charge an inheritance tax are.

Even though Tennessee does not have an inheritance tax other states do. The inheritance tax is different from the estate tax. The tax in these states ranges from 0 to 18.

You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only. Tennessee does not have an estate tax. Inheritance taxes in Tennessee.

Depending on whether or not youve prepared a valid will at the time of your death Tennessee inheritance laws surrounding your estate will vary wildly. How do inheritances get assessed for tax purposes. How much can you inherit without paying taxes in 2020.

Gift and Generation-Skipping Transfer Tax Return. The net estate is the fair market value of all. Whether or not you have to pay inheritance tax depends on the state you live in the size of the inheritance and your.

Also in this case you need to file Form 709. Inheritance tax rates differ by the state. There are NO Tennessee Inheritance Tax.

If you receive property in an inheritance you wont owe any federal tax. No tax for decedents dying in 2016 and thereafter. The estate of a non-resident of Tennessee would not receive the full exemption.

The federal government does not have an inheritance tax. All inheritance are exempt in the State of Tennessee. Ad Get an Estate Planning Checklist More to Get the Information You Need.

Tennessee Inheritance and Gift Tax. Ad Inheritance and Estate Planning Guidance With Simple Pricing. Be aware of that your assets located in other states may be subject to that localitys inheritance or.

Annual Tn Business Tax Seminar

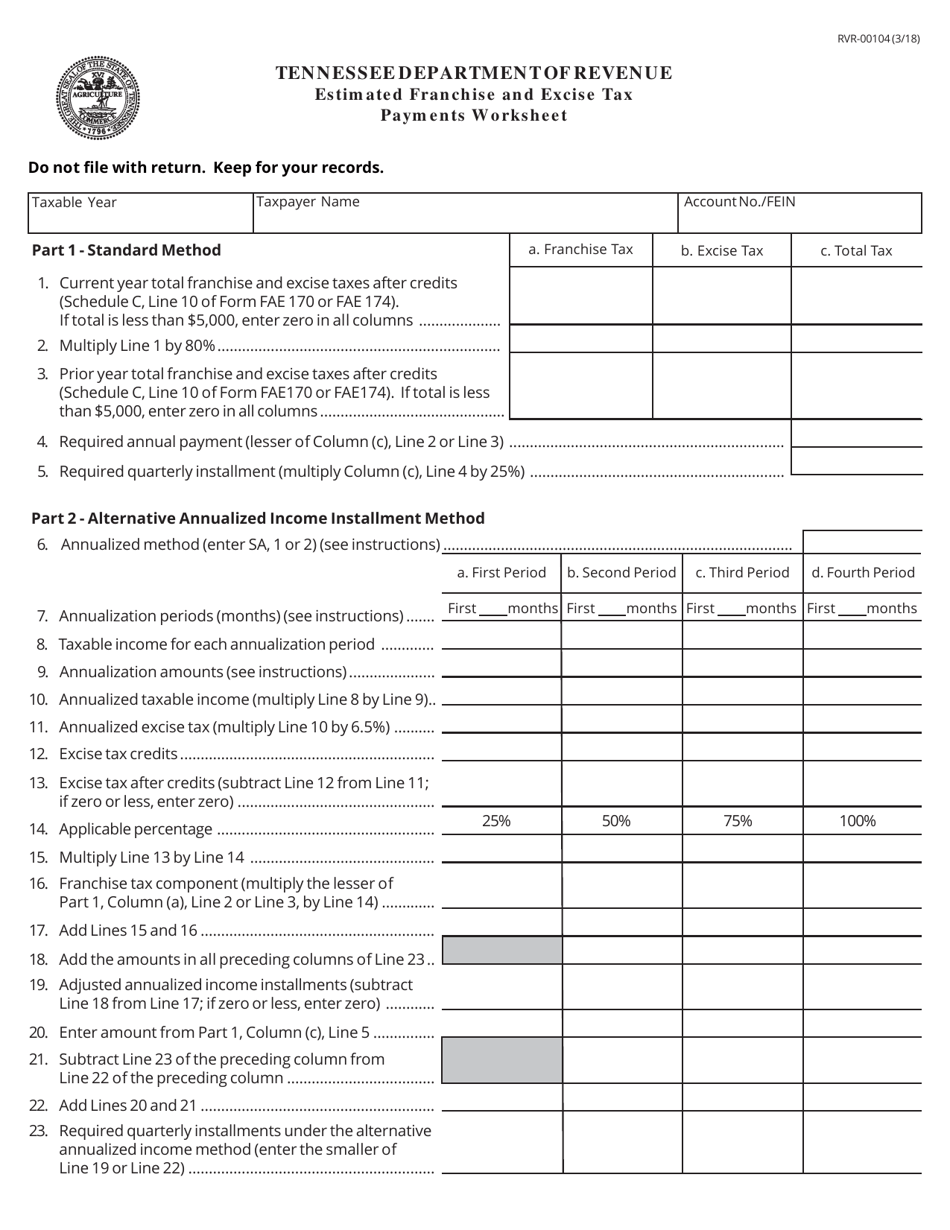

Form Rvr 00104 Download Printable Pdf Or Fill Online Estimated Franchise And Excise Tax Payments Worksheet Tennessee Templateroller

Do You Need A Tax Id Number When The Trust Grantor Dies Probate When Someone Dies Last Will And Testament

Unemployed On Obamacare Does Withdrawls From My Ira Or 401k Count As Income Healthtn

Fill In State Inheritance Tax Return Short Form

State By State Guide To Taxes On Retirees Tennessee Gas Tax Inheritance Tax Income Tax

Tn Rv F1310501 2020 2022 Fill Out Tax Template Online Us Legal Forms

2013 2022 Form Tn Rv F1400301 Fill Online Printable Fillable Blank Pdffiller

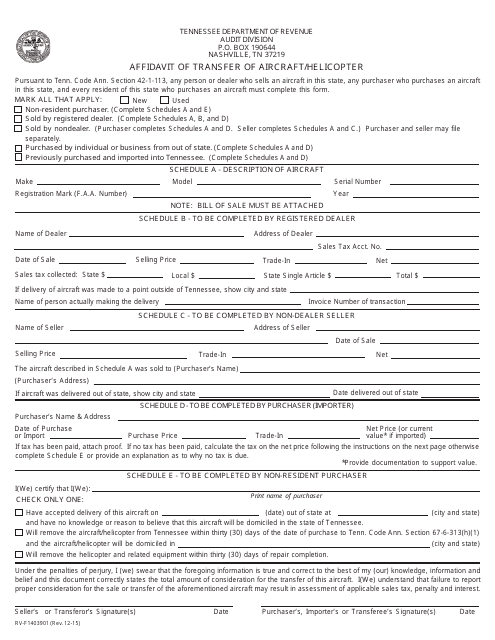

Form Rv F1403901 Download Printable Pdf Or Fill Online Affidavit Of Transfer Of Aircraft Helicopter Tennessee Templateroller

3 Simple Ways To Avoid Probate In Tennessee James D Foster Law

Divorce Laws In Tennessee 2022 Guide Survive Divorce